5 Low-Volatility Stocks to Buy Right Now

In this article, we will dive into why investing in low-volatility stocks can be a good idea and what our favorite stocks in this segment are.

Why is low volatility good?

Contrary to common investing beliefs, lower-risk stocks outperform higher-risk ones over the long term. Investors can use this circumstance to build a better portfolio with a higher overall return but also better risk-adjusted returns.

Is low volatility good for stocks?

Yes, low volatility is in general good for stocks. Unfortunately, low volatility as a factor alone is not sufficient to make sensible investment decisions. Intelligent investors should also consider factors such as fundamentals, momentum, the market environment, and social sentiment in their analysis.

Investigating a company is a demanding and time-consuming task. FinCorner can help you eliminate the hassle of finding and deep-researching suitable stocks. Our FinCorner StockWizard™ AI makes finding the right investment a breeze. Just run any stock through our advanced investment AI and get a hedge fund grade stock analysis in seconds.

Join us as we delve deeper into the merits of low volatility and unveil five compelling stocks that offer both security and steady growth.

Our 5 favorite low-volatility stocks

These are the 5 best low-volatility stocks to buy right now in our opinion. We selected the companies based on their low beta, their valuation, and their growth prospects.

- JD.com

- T-Mobile US

- Arch Capital Group

- Honda Motor Company

- Globe Life Inc.

JD.com

JD.com is one of China's largest e-commerce platforms. Beyond its vast online marketplace, the company is recognized for its commitment to technology, owning one of the world's topmost drone delivery systems and leveraging advanced automation in its warehouses.

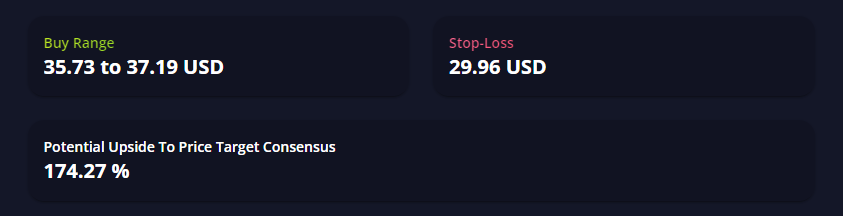

The stock has caught our eye because of the stark disparity between its current price and the consensus price target. Analysts see shares of JD.com on average 174.27% higher than the current level. This gives the stock a very favorable risk/return profile.

Right now, the stock is trading at $34.88 as of the 16th of August and thus even below our buy range. We see the stock significantly higher in the near future. This is notwithstanding that you always need to set a stop-loss to limit your downside risk. Our AI recommends putting the stop-loss just below the $30 mark.

One thing that persistently shows up in the data concerning JD.com, is the discount rate at which the company and Chinese stocks in particular are traded. You can see that very beautifully in our DCF chart. Right around March 2021, the spread between the theoretical fair value based on future cash flows has widened significantly. This was caused by US sanctions on Chinese companies because of the US-Chinese trade war. For savvy investors, this creates an opportunity to get their hands on the stock for cheaper than they usually could. It is also worth mentioning that although the actual discount in dollar terms looks steady, the discount on a percentage basis has never been higher.

The fact that you can get the stock literally at a discount while analysts are still bullish on the stock should be a further sign that JD.com is a good deal right now.

In addition to that, sentiment around JD.com appears to have changed. This is in particular the case if you look at the amount of put and call options bought by institutions. For around a year we have seen a high uptick in call options coinciding with a steady and even decreasing inventory of put options. This suggests that a turnaround to the upside is highly expected.

T-Mobile US

Based in Bellevue, Washington, T-Mobile US is a major telecommunications company in the United States.

T-Mobile is not the cheapest stock in the telecommunication industry, but we still think it is worth a shot. The digital transformation and the race for bandwidth are long from over. This puts T-Mobile in an interesting spot and the growth prospects are intact.

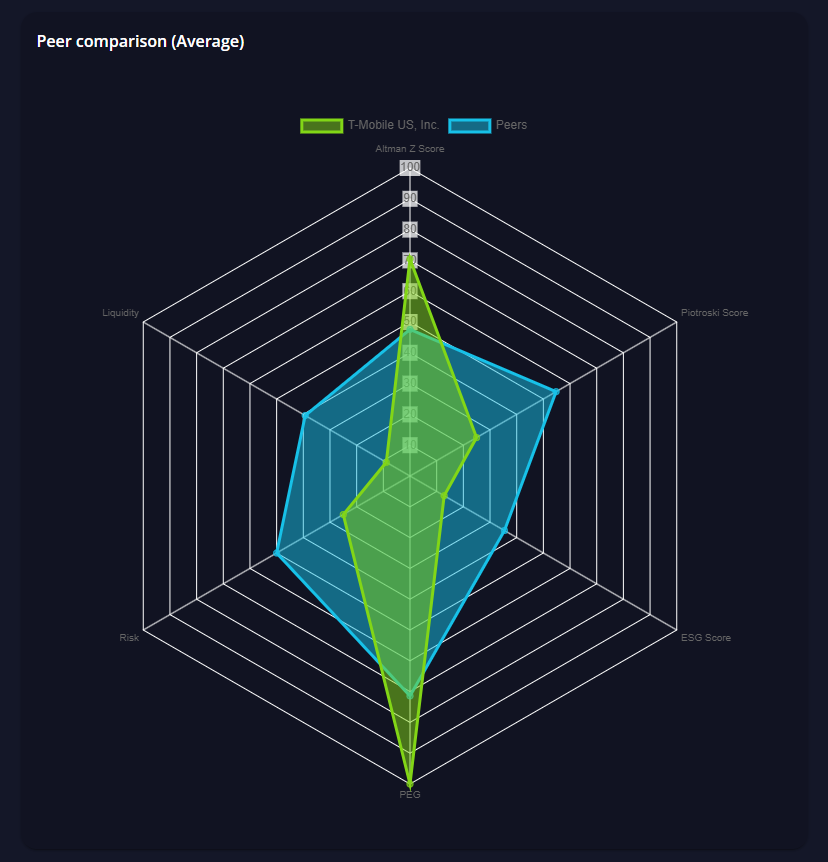

We have mentioned that T-Mobile is not the cheapest stock in its industry measured by its earnings multiple. This is notwithstanding that it offers the best deal compared to the growth you get for the price. As seen in the radar chart below T-Mobile beats its competitors with its very competitive PEG ratio.

Analysts certainly seem to share our opinion of the stock with a staggering majority of them rating T-Mobile US as a buy.

We see the stock higher in the next six months. According to the analyst’s price target consensus, the stock has a potential upside of 23.40 % which would put the stock at around $170. We see the stock a bit lower at $155 over the coming months which is equal to a return of 12%. As always it is important to set a stop-loss for risk management purposes. At a price of $128.52, we would sell the stock and try to enter the position again at a later point in time.

Arch Capital Group

Headquartered in Pembroke, Bermuda, Arch Capital Group is a global insurance and reinsurance company.

Arch Capital Group has left an impression on us because of its remarkably low PEG ratio. This means that the company is very attractively priced compared to the growth you get from the business.

Although there are competitors that are lower priced than Arch Capital Group, we believe that the strong technical uptrend and the social sentiment around the stock make up for it. The higher price can be justified by the strong earnings growth of Arch Capital. Considering the relatively narrow growth trend of the stock every chance to get Arch Capital below an all-time high should be considered as an opportunity. We are confident to see the stock higher six months from now.

Honda Motor Company

Originating from Tokyo, Japan, Honda Motor Company is a multinational conglomerate renowned for its diverse range of automobiles, motorcycles, and power equipment. Apart from being one of the world's largest automobile manufacturers, Honda is equally celebrated for its innovations in motorcycles and is a dominant name in motorsport. Over the decades, the brand has become synonymous with engineering excellence, fuel efficiency, and reliability in its products.

Honda Motor Company is a very interesting stock. In line with a lot of Japanese companies, Honda has a very low P/E ratio and even a price-to-book (P/B) ratio below one. For starters, a P/B ratio below one means that the assets per share are worth more than the price you have to pay to acquire the share. In other words, you can buy one dollar for less than a dollar.

Furthermore, Honda is profiting from wider economic factors. The depreciation of the Japanese Yen will lead to bigger earnings for Honda when the company converts its earnings from abroad to the local currency. Moreover, a weaker Yen makes imports from Japan more attractive. This could lead to more sales for Honda Motors.

Besides the low valuation, the stock exceeds in all our metrics and is rated as a buy by our StockWizard™ AI. Considering the strong momentum Japanese stocks have anyway because of macroeconomic factors, we think that Honda Motors is uniquely positioned to grow in the coming six months.

Globe Life Inc.

Globe Life Inc. is a prominent insurance holding company from Texas.

Globe Life had an astonishing recovery after the 2020 stock market crash during the pandemic. Since then, shares of Globe Life have appreciated in an unbroken and strong uptrend. We think this reflects the robustness of the business and think that right now is a good point in time to load up some shares in the company.

We see the momentarily down in the stock price as an opportunity to get in below an all-time high. We believe that the growth of the company will stay in line with its current trajectory and have a high conviction that the stock will be higher six months from now. The 19.83% upside to the analyst consensus could be within reach.

Picture by Aleksandar Pasaric from Pexels: https://www.pexels.com/de-de/foto/blick-auf-das-stadtbild-325185/

Disclaimer

This is not financial advice. FinCorner does not take any responsibility/liability for losses or gains of any kind. This content is only for entertainment purposes only.